Customising Payment Gateways for B2B Transactions: Streamlining Business Payment Processing and Invoicing Solutions

Why B2B Payments Require Customised Solutions

Imagine closing a major deal with a corporate client, but the payment process is clunky and riddled with delays. Your customer feels the friction, and your cash flow takes a hit. In B2B transactions, a seamless payment processing experience is not just desirable—it’s essential.

B2B payments differ from consumer payments. They are usually larger and more complex. Also, they involve many stakeholders. Businesses require invoicing solutions that fit their workflows. This includes invoicing, recurring billing, and flexible payment terms.

In this guide, we’ll look at how to customise payment gateways for B2B transactions. We’ll explain business payment processing and share strategies to improve your payment systems. No matter if you provide SaaS, make products, or offer services, this article will help you simplify your payment processes.

Understanding the Complexity of B2B Payments

1. Higher Transaction Values

B2B payments typically involve large sums compared to B2C.

- Scenario: A manufacturer processes a £50,000 order for raw materials.

2. Extended Payment Terms

Businesses often negotiate net payment terms (e.g., net 30, net 60).

- Example: A supplier offers a 60-day payment window to corporate clients.

3. Invoicing and Purchase Orders

Payments are frequently tied to invoicing cycles and purchase orders.

- Outcome: Requires flexible invoicing solutions and tracking mechanisms.

4. Multiple Payment Methods

Beyond cards, B2B transactions may involve ACH transfers, wire transfers, or cheques.

- Benefit: Offering various methods accommodates different clients’ preferences.

Key Features to Look for in B2B Payment Gateways

1. Flexible Invoicing Solutions

Supports customised invoices with payment terms, purchase order matching, and reminders.

- Tip: Automate invoice generation and tracking.

2. Multiple Payment Methods Support

Accepts ACH transfers, wire transfers, credit cards, and digital wallets.

- Example: Enable ACH payments for recurring clients to reduce fees.

3. Custom Payment Terms and Schedules

Accommodates various net payment terms (e.g., net 30, net 60).

- Scenario: Allow clients to split payments or schedule instalments.

4. Advanced Reporting and Reconciliation Tools

Track payments, outstanding invoices, and reconcile transactions with accounting systems.

- Benefit: Simplifies financial reporting and cash flow management.

5. Enhanced Security and Compliance

Ensure PCI DSS compliance, data encryption, and fraud detection.

- Outcome: Protects sensitive business payment processing data.

6. CRM and ERP Integrations

Integrates with platforms like Salesforce, NetSuite, and QuickBooks.

- Tip: Sync customer data, invoices, and payments for seamless operations.

Best Payment Gateways for B2B Transactions

1. Stripe

- Strengths: Customisable APIs, supports ACH, wire transfers, and invoicing.

- Features: Automated invoicing, flexible payment terms, multi-currency support.

- Ideal for: SaaS companies and businesses needing tailored integrations.

2. PayPal for Business

- Strengths: Wide acceptance, integrates with many B2B platforms.

- Features: Invoice creation, recurring payments, and multiple payment methods.

- Ideal for: Small to mid-sized businesses.

3. Square for Invoices

- Strengths: User-friendly invoicing tools, flexible payment options.

- Features: Custom invoices, payment tracking, ACH payments.

- Ideal for: Service-based businesses and freelancers.

4. Authorize.Net

- Strengths: Supports complex business payment processing.

- Features: Recurring billing, invoicing, ACH and card payments.

- Ideal for: Larger enterprises with high transaction volumes.

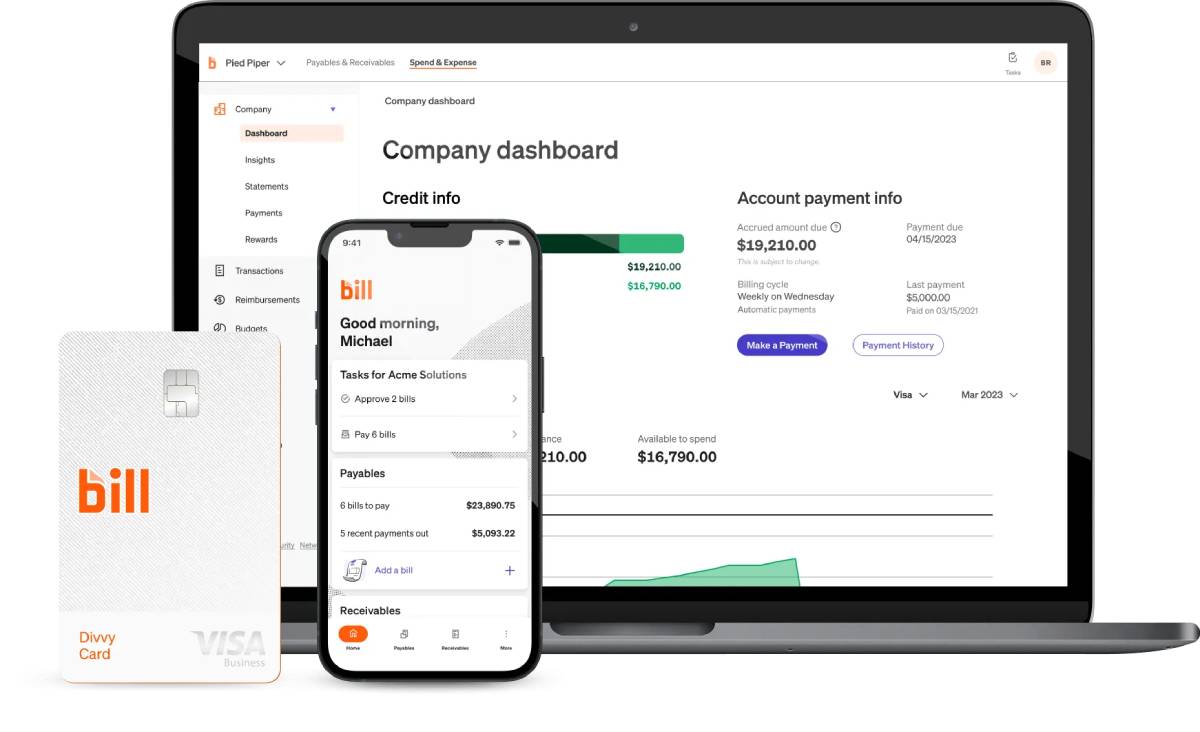

5. Bill.com

- Strengths: Tailored for B2B payments and invoicing.

- Features: Automated invoice workflows, approvals, and ACH transfers.

- Ideal for: Businesses with extensive accounts payable/receivable needs.

Real-World Scenario: Streamlining B2B Payment Processing

A SaaS company providing enterprise software had trouble getting paid on time. This was because they used manual invoicing and offered few payment options. Integrating Stripe’s B2B payment gateway with ACH and automated invoicing cut payment delays by 40%. This also boosted cash flow predictability.

This case shows that customising payment gateways for B2B transactions boosts efficiency and financial stability.

Best Practices for Customising B2B Payment Gateways

1. Offer Flexible Payment Terms

Accommodate your clients’ cash flow cycles with custom terms.

- Example: Provide discounts for early payments or instalment plans.

2. Automate Invoicing and Reminders

Use tools to generate, send, and follow up on invoices automatically.

- Benefit: Reduces administrative overhead and speeds up collections.

3. Integrate Payment Systems with CRMs and ERPs

Sync payment data with your operational platforms.

- Tip: Avoid manual entry errors and streamline workflows.

4. Implement Strong Security Measures

Protect sensitive business payment processing data with encryption and compliance.

- Outcome: Safeguards your business and builds client trust.

5. Monitor Payment Metrics Regularly

Track Days Sales Outstanding (DSO), overdue invoices, and payment trends.

- Strategy: Use insights to optimise payment terms and cash flow management.

Comparing B2B Payment Gateways

| Gateway | ACH Support | Invoicing Solutions | Custom Payment Terms | ERP Integration |

| Stripe | Yes | Yes | Yes | Yes |

| PayPal | Limited | Yes | Limited | Yes |

| Square | Yes | Yes | Limited | Limited |

| Authorize.Net | Yes | Yes | Yes | Yes |

| Bill.com | Yes | Yes | Yes | Yes |

This comparison helps you pick the best gateway for your B2B payments and operations.

Trends in B2B Payments for 2025

1. AI-Driven Cash Flow Forecasting

AI analyses payment trends to predict cash flow fluctuations.

2. Increased Adoption of Digital Wallets

More businesses are using wallets like PayPal and Apple Pay for B2B transactions.

3. Blockchain for Transparent Invoicing

Using blockchain to track invoices enhances trust and reduces disputes.

4. Enhanced Cross-Border Payment Solutions

Gateways are improving multi-currency and real-time payment capabilities for global B2B transactions.

Staying informed on these trends ensures your business payment processing remains competitive.

Conclusion: Optimise Your B2B Payment Systems for Growth

B2B payments have specific challenges. They need special payment gateways and invoicing solutions. Customising your payment processing can help your business. Offer flexible terms, automate invoicing, and integrate with your tools. This way, you can streamline transactions, boost cash flow, and build stronger client relationships.

Ready to optimise your B2B payments? Share your questions or experiences below. Also, subscribe for more tips on improving payment systems for businesses like yours!