Mobile Wallets: Opportunities and Challenges in Digital Payment Solutions

Why Mobile Wallets Are Reshaping Payments

Imagine standing at a crowded checkout, and instead of fishing for your card or cash, you simply tap your smartphone and walk away. Quick, simple, seamless. Mobile wallets are now a key part of mobile payment solutions.

As digitalisation speeds up, mobile wallets are changing how we pay. These apps safely store payment info for in-store, online, or in-app purchases. Apple Pay, Google Pay, and regional tools like Alipay make payments easy. But they also bring new challenges.

In this guide, we’ll explore the ups and downs of digital wallet integration. You’ll get a clear roadmap to use their potential in your business. This article will guide e-commerce merchants and brick-and-mortar retailers through mobile payment solutions.

What Are Mobile Wallets?

Mobile wallets are apps that safely keep payment methods, loyalty cards, and IDs on your phone. They use NFC (Near Field Communication) or QR codes to facilitate mobile payment solutions.

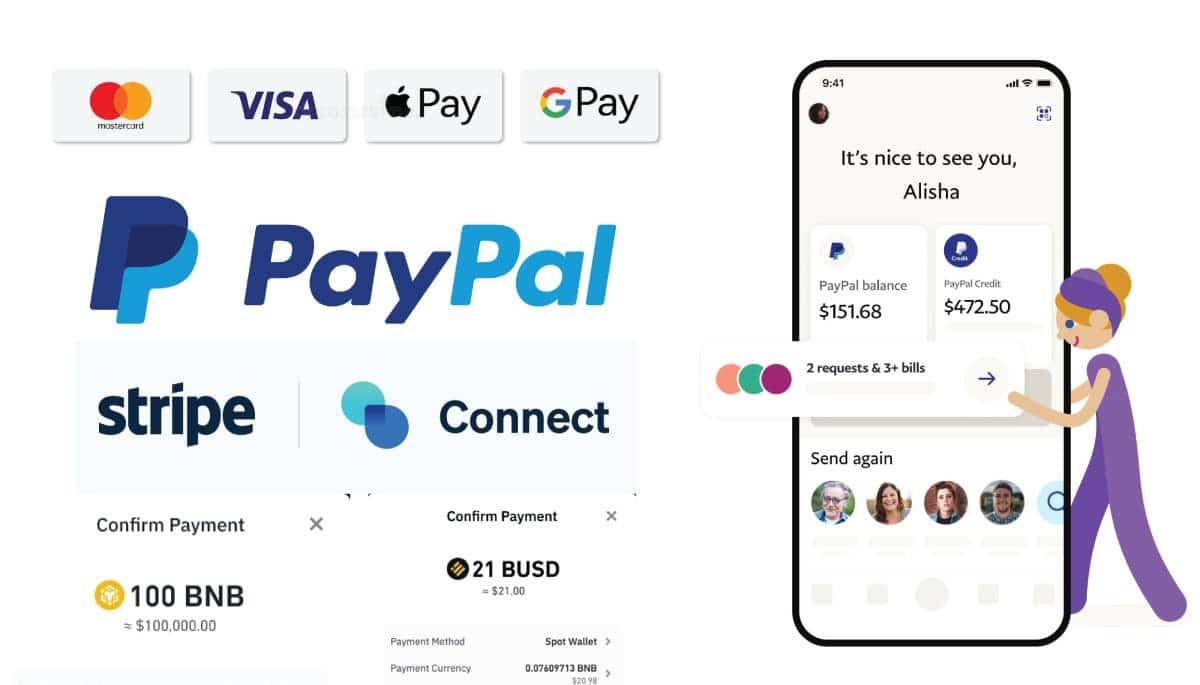

Popular Mobile Wallets:

- PayPal Mobile

- Apple Pay

- Google Pay

- Samsung Pay

- Alipay

- WeChat Pay

These platforms let consumers pay without contact, speed up checkout, and improve security.

Opportunities Presented by Mobile Wallets

1. Enhanced Customer Convenience

Mobile wallets streamline the payment process, reducing friction at checkout.

- Scenario: A shopper in a rush uses Apple Pay, completing the transaction in seconds.

2. Increased Sales and Conversion Rates

Simplified payments lead to higher conversion rates, especially on mobile platforms.

- Fact: A study by Adobe found that mobile wallet users are 23% more likely to complete purchases.

3. Improved Security Features

Digital wallet integration uses tokenization and biometric authentication, like fingerprints and Face ID. This helps lower fraud risks.

- Benefit: Less sensitive data is stored, lowering the risk of breaches.

4. Access to New Markets

Regions like Asia and Africa have leapfrogged card-based systems, adopting mobile wallets directly.

- Example: Alipay and WeChat Pay lead in China. This makes digital wallet integration a must for foreign businesses.

5. Loyalty and Engagement Opportunities

Integrating loyalty programmes or personalised offers within mobile wallets boosts customer retention.

- Tip: Offer digital coupons or rewards that are redeemable via wallets.

Challenges of Integrating Mobile Wallets

1. Fragmented Market Landscape

Businesses need to integrate various platforms to serve global customers. This is important due to different wallets and regional differences.

- Example: Alipay in China, Paytm in India, Apple Pay in the US.

2. Technical Complexity

Integrating digital wallets means changing POS systems, mobile apps, and websites. They need to support different wallet protocols.

- Tip: Choose payment processors offering pre-built integrations.

3. Compliance and Data Privacy Regulations

Handling payment data means following laws like GDPR, CCPA, and local data protection rules.

- Solution: Partner with compliant payment gateways.

4. Transaction Fees and Costs

Wallet providers may impose transaction fees that can impact profit margins.

- Strategy: Factor these costs into your pricing model.

5. Consumer Trust and Adoption

While growing, not all consumers are comfortable using mobile wallets.

- Scenario: Some customers prefer traditional payment methods or worry about security.

Best Practices for Successful Digital Wallet Integration

1. Understand Your Audience

Research which mobile wallets are popular among your target customers.

- Example: Prioritise Alipay and WeChat Pay for Chinese consumers.

2. Choose a Reliable Payment Processor

Select gateways that support multiple mobile payment solutions.

- Popular Processors: Stripe, Adyen, PayPal, Square.

3. Ensure Seamless User Experience

Optimise the checkout process for mobile devices with an intuitive design.

- Tip: Minimise form fields and clicks.

4. Prioritise Security and Compliance

Use tokenisation, encryption, and comply with PCI DSS standards.

- Example: Leverage biometric authentication through wallets.

5. Test Across Platforms and Devices

Ensure compatibility with iOS, Android, and various browser environments.

- Tip: Use sandbox environments to simulate transactions.

Real-World Scenario: Boosting Conversions with Mobile Wallets

A mid-sized e-commerce store focused on fashion saw a 30% cart abandonment rate on mobile. After adding Google Pay and Apple Pay, they saw a 20% boost in completed transactions in the first quarter.

This success happened by making mobile payments easier and removing checkout barriers. It shows that digital wallet integration can boost sales directly.

Comparing Mobile Wallets: Features and Reach

| Wallet | Device Compatibility | Security Features | Regions Dominated |

| Apple Pay | iOS devices | Face ID, tokenisation | North America, Europe |

| Google Pay | Android, web browsers | Fingerprint, encryption | Global |

| Samsung Pay | Samsung devices | MST, NFC, tokenisation | Asia, North America |

| Alipay | Mobile, web apps | QR codes, facial recognition | China, Southeast Asia |

| WeChat Pay | WeChat app | QR codes, PIN, biometrics | China |

This comparison shows the variety of mobile wallets. It helps you choose the best ones for digital wallet integration.

Trends in Mobile Wallets for 2025

1. Biometric Advancements

Enhanced biometric authentication, like facial, fingerprint, and voice recognition, is making mobile wallets safer and easier to use.

2. Cryptocurrency Integration

Some wallets now support crypto payments. This gives tech-savvy users more options.

3. AI-Powered Personalisation

Mobile wallets will give personalised promotions and loyalty rewards. They will focus on your spending habits.

4. Expansion of Wearable Payments

Smartwatches and fitness trackers equipped with mobile wallet functionalities are on the rise.

Keeping up with these trends keeps your mobile payment solutions competitive and relevant.

Conclusion: Harness the Power of Mobile Wallets for Business Growth

Mobile wallets offer great chances to make payments easier, boost conversions, and explore new markets. Successful digital wallet integration needs to consider regional preferences. It also requires strong security and a smooth user experience.

Embracing mobile payment solutions helps your business stay current with new technologies. This will allow you to future-proof your operations and meet the needs of today’s tech-savvy consumers.

Are you leveraging mobile wallets in your business? Share your thoughts or questions in the comments! Also, subscribe for more tips on optimising your payment strategies!